What is Forex Trading?

Forex trading is the act of buying and selling currencies on the foreign exchange market. When trading forex online, you are relying on the value of the currencies you are trading to change in your favour. We offer clients transparent pricing on a wide range of currency pairs. Manage your market exposure and apply your Forex trading strategy via an MT5 trading account with Blackwell Global. To learn more about Forex and improve your knowledge, check out our trading guides here.

What is Forex Trading?

Forex trading is the act of buying and selling currencies on the foreign exchange market. When trading forex online, you are relying on the value of the currencies you are trading to change in your favour. We offer clients transparent pricing on a wide range of currency pairs. Manage your market exposure and apply your Forex trading strategy via an MT5 trading account with Blackwell Global. To learn more about Forex and improve your knowledge, check out our trading guides here.

Why Trade with Blackwell Global?

Why Trade with Blackwell Global?

50+ Currency Pairs

Trade over 50 FX pairs using one of the world’s most popular platforms

Zero Fees

Blackwell Global does not charge fees for deposits and withdrawals

Fast Execution and Low Spreads

Competitive spreads and fast execution to provide traders with a superior trading environment

EA Trading Welcome

Trade on our platform using your own strategy or using an EA

No Brokerage Fees

Benefit from no brokerage fees on standard accounts with Blackwell Global

Trusted Brand

Trade with a trusted, regulated and award-winning broker

50+ Currency Pairs

Trade over 50 FX pairs using one of the world’s most popular platforms

Zero Fees

Blackwell Global does not charge fees for deposits and withdrawals

Fast Execution and Low Spreads

Competitive spreads and fast execution to provide traders with a superior trading environment

EA Trading Welcome

Trade on our platform using your own strategy or using an EA

No Brokerage Fees

Benefit from no brokerage fees on standard accounts with Blackwell Global

Trusted Brand

Trade with a trusted, regulated and award-winning broker

The Most Competitive Spreads

We strive to deliver the best pricing and best execution, so your strategies are as optimised as possible.

- Forex

- Commodities

- Indices

The Most Competitive Spreads

We strive to deliver the best pricing and best execution, so your strategies are as optimised as possible.

- Forex

- Commodities

- Indices

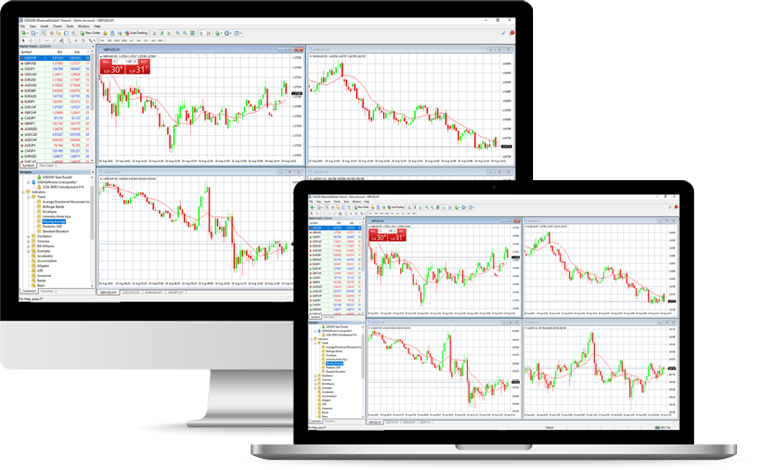

Start Trading Forex Today

1) Open a free trading account

2) Deposit funds using one of our various payment methods

3) Download our platform and start trading

Start Trading Forex Today

1) Open a free trading account

2) Deposit funds using one of our various payment methods

3) Download our platform and start trading

Start Trading Forex Today

1) Open a free trading account

2) Deposit funds using one of our various payment methods

3) Download our platform and start trading

Factors that move the Forex market

Interest Rates

Inflation

Economic Stability

Global Events

Trade Balance

Government Debt

Factors that move the Forex market

Interest Rates

Inflation

Economic Stability

Global Events

Trade Balance

Government Debt

Discover more popular markets to trade