Why Choose The ECN Account?

Why Choose The ECN Account?

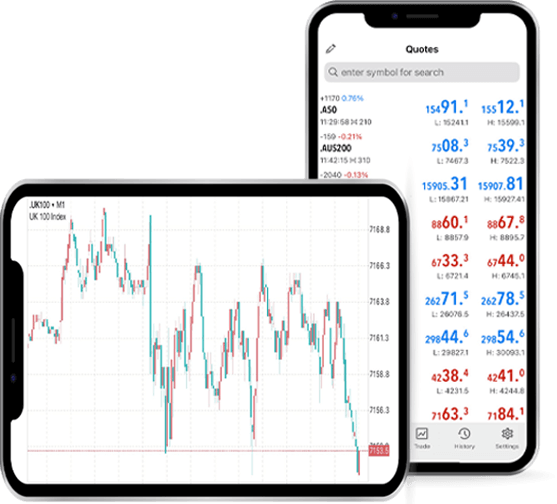

Tight Spreads

Keep trading costs low with spreads from 0.0 pips and no requotes

1:200 Leverage

Maximise your profits by trading with leverage

Low Minimum Deposit

Start trading in minutes as soon as your account is funded

Trade Micro Lots

Fine-tune your trading strategies by using Micro Lots

Low Commissions

Benefit from our super low commission at only $9 per round trip

Tier 1 Liquidity

Fast order execution, low latency and transparent pricing

Tight Spreads

Keep trading costs low with spreads from 0.0 pips and no requotes

1:200 Leverage

Maximise your profits by trading with leverage

Low Minimum Deposit

Start trading in minutes as soon as your account is funded

Trade Micro Lots

Fine-tune your trading strategies by using Micro Lots

Low Commissions

Benefit from our super low commission at only $9 per round trip

Tier 1 Liquidity

Fast order execution, low latency and transparent pricing

Swift and Secure Funding

Start trading in minutes by choosing one of our many secure funding methods

Swift and Secure Funding

Start trading in minutes by choosing one of our many secure funding methods

Credit Card

Debit Card

Bank Transfer

Skrill

Neteller

Credit Card

Debit Card

Bank Transfer

Skrill