Trump’s Tariffs to Impact Over 50% of EU Exports to the US

President Donald Trump’s initial announcement of sweeping 10% tariffs plus 25% on steel and aluminium was already worrying for the EU. Things took a turn for the worse when Trump threatened to raise the tariffs on EU exports to 50% on May 23, 2025. Fortunately, this hike was paused following discussions with EC President Ursula von der Leyen. The EU has until July 9 to negotiate a deal with the US. While President Trump agreed to a trade deal with the UK at the June G7 summit, he stated that the EU had failed to offer “a fair deal.”

Regardless of the quantum of the tariffs, over 50% of the EU’s exports to the US will be impacted. How will this affect the bloc’s economy and financial markets? Here’s a look.

Implications of the Trump Tariffs on the EU Economy

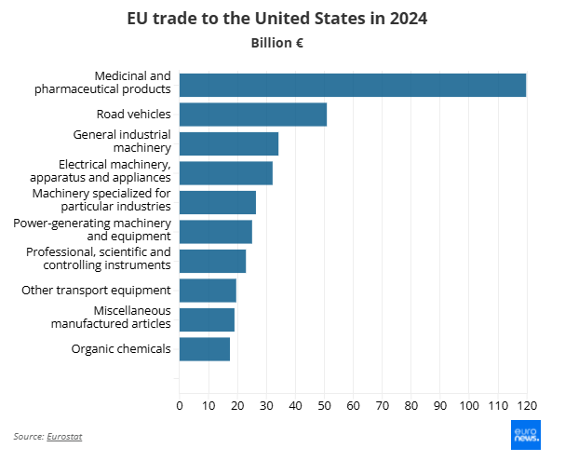

Trump’s aggressive stance is driven by a philosophy of reciprocal tariffs and a desire to address perceived trade imbalances. However, the US is the EU’s largest trade partner, accounting for 20.6% of the latter’s exports worth over €530 billion in 2024. This means the tariffs could trigger significant economic disruption and cause volatility in the financial markets.

Source: Eurostat

While earlier estimates suggested around 5% of total EU goods exports (equating to approximately €26 billion) were initially vulnerable to a 20% tariff, the broader application of reciprocal tariffs, coupled with sector-specific levies on industries like automobiles, pharmaceuticals and machinery, paints a far more dire picture. Should the higher tariffs come into full effect, sectors heavily dependent on the US market, such as Germany’s automotive industry, France’s luxury goods and various pharmaceutical producers across the bloc, would face immense pressure. This would lead to reduced competitiveness for EU producers and potentially significant job losses within the EU.

Although the stated aim of such tariffs is to promote domestic manufacturing in the US and address trade deficits, the higher tariffs will raise the price of goods for US consumers and be a drag on global growth. Numerous analysts state that the higher tariffs could also result in a recession in the EU, which would trigger the ECB to cut interest rates more than previously expected.

The European Commission lowered its economic forecast before the threat of 50% tariffs, factoring in potential 10%-20% tariffs, as well as the impact of uncertainty. The eurozone PMI for April 2025 revealed a contraction in the services sector, although the manufacturing sector held up better. However, it reflected that business confidence declined following the Trump tariffs, dropping to its lowest in almost 2.5 years.

Impact on the Financial Markets

The uncertainty and direct economic impact of these tariffs have already sent tremors through European financial markets. Stock markets across the US witnessed heightened volatility, with broad indices like the STOXX 600 experiencing sharp declines following tariff threats. Sectors particularly exposed to US exports, such as automobiles, pharmaceuticals and luxury goods, have been among the hardest hit, with their stock prices plummeting as investors price in the anticipated reduction in demand and profitability. Germany’s DAX, heavily weighted towards export-oriented industries, has also seen significant swings.

Following Trump’s threat of raising the tariffs on EU exports to 50%, Germany’s DAX declined 2.6%, while the French CAC fell by 2.8%. The ripple effect was felt beyond the EU, with the FTSE 100 dropping 1.3% and DJIA down 1.7%. A potential US-EU trade war dampened investor sentiment. The impact of the tariff war on market sentiment was further highlighted when President Trump decided to delay the 50% tariffs on May 27. The S&P 500 climbed 2.1%, the Dow Jones gained 1.8% and the Nasdaq Composite was up 2.5%.

The euro’s valuation is also intricately linked to the unfolding trade tensions. Historically, traders flock to the safe haven US dollar, leading to the greenback strengthening against the EUR. Plus, the prospect of reduced exports to a major trading partner and a potential recession in the eurozone would exert downward pressure on the euro. Although a weaker euro is likely to make EU exports more competitive, partially offsetting the tariff impact, the overall negative sentiment and economic headwinds could overshadow any competitive advantage from a depreciated currency. And while the ECB has already taken steps to cushion the economic blow, such as cutting interest rates, its ability to counteract a full-blown trade war is limited.

Tips to Navigate the Tariff-Induced Market Volatility

Uncertain times bring volatility to the financial markets. But volatility isn’t all bad. While it increases risks for traders, it also brings trading opportunities. Here are some tips to help you minimise losses and capture opportunities.

Diversification is Key

Spread your investments across different sectors, geographic regions and asset classes. This helps mitigate the impact of tariffs on any single industry or market. Consider increasing allocations to defensive sectors that are less exposed to international trade, such as utilities, consumer staples or healthcare (although the EU’s pharmaceutical exports are vulnerable). Hedge trades with positions in uncorrelated or negatively correlated assets.

Know When to Take a Break

Don’t let any type of fear (including FOMO) or greed dictate trading decisions. Stick to your trading strategy and take a break if you feel your stress levels rising. Keeping emotions out of trading and focusing on the long-term can help weather volatility storms. Do your research rather than only buying because an asset is cheap.

Rebalance Your Portfolio

Regularly rebalancing your portfolio ensures it remains aligned with your risk tolerance and investment goals. If certain assets have become overweight due to market movements, rebalance them to maintain your desired asset allocation.

Stay Informed, Not Obsessed

Stay updated on geopolitical and trade developments, but avoid letting daily headlines dictate your trading decisions. Focus on your long-term objectives and avoid emotional reactions to short-term market swings. Tools that provide real-time market data and analysis can be helpful, but they should not lead to impulsive trading.

In other words, stay calm and keep trading, but with proper analysis and risk management.

To Sum Up

- Trump’s tariffs are likely to affect over 50% of the EU’s exports to the US.

- The tariffs could be as high as 50% if the eurozone fails to negotiate a trade deal.

- The tariffs will significantly impact the EU’s economy since the US is the bloc’s largest trading partner.

- The sectors likely to be most affected include automobiles, luxury goods and pharmaceuticals.

- The tariffs have already negatively impacted business confidence and investor sentiment.

- If the tariffs lead to recession, the ECB might be forced to increase its interest rate cuts.

- The eurozone’s stock markets declined following the tariff announcements.

- The delay in the levying of the 50% tariffs positively affected the global stock markets.

- The euro could weaken due to the Trump tariffs.

- Traders must focus on diversification, keep emotions at bay, rebalance their portfolios and stay informed to navigate market volatility.

Disclaimer:

All data, information and materials are published and provided “as is” solely for informational purposes only, and is not intended nor should be considered, in any way, as investment advice, recommendations, and/or suggestions for performing any actions with financial instruments. The information and opinions presented do not take into account any particular individual’s investment objectives, financial situation or needs, and hence does not constitute as an advice or a recommendation with respect to any investment product. All investors should seek advice from certified financial advisors based on their unique situation before making any investment decisions in accordance to their personal risk appetite. Blackwell Global endeavours to ensure that the information provided is complete and correct, but make no representation as to the actuality, accuracy or completeness of the information. Information, data and opinions may change without notice and Blackwell Global is not obliged to update on the changes. The opinions and views expressed are solely those of the authors and analysts and do not necessarily represent that of Blackwell Global or its management, shareholders, and affiliates. Any projections or views of the market provided may not prove to be accurate. Past performance is not necessarily an indicative of future performance. Blackwell Global assumes no liability for any loss arising directly or indirectly from use of or reliance on such information here in contained. Reproduction of this information, in whole or in part, is not permitted.